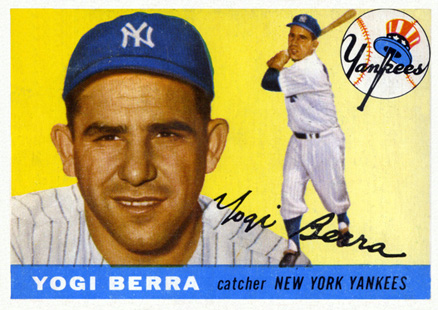

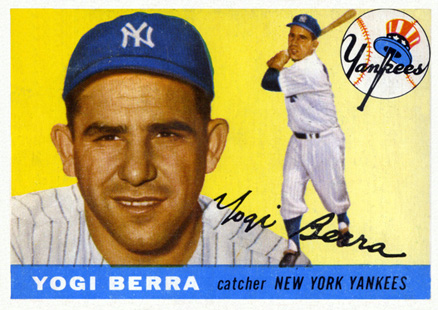

* Yogi Berra.

Yogi Berra passed away last night at the age of 90.

Now real fast, name the New York Yankees’ current starting catcher. Or how about the name of the Yankees’ current starting left-fielder!

Times sure have changed.

Make sure that you eat those hot dogs with mustard and sauerkraut, French fries with loads of ketchup, pizza slices- and drink those chocolate shakes…because I’m pretty sure that- you only get to go around once!

______________

from sports.yahoo.com

Yogi Berra 1925-2015: Sports world mourns the loss of baseball icon Yogi Berra

Yogi Berra: A celebration of baseball, life and a man’s legacy of words Jeff Passan By Jeff Passan

One of the most beautiful lives baseball has known, full of accomplishment and achievement, of kindness and compassion, of malapropism and solecism, ended Tuesday night. Yogi Berra died at 90 and took with him a legacy inimitable in every way imaginable. More than his play on the field, his words defined him and will continue to do so long after his passing. Because nobody knew how to mangle the English language as gloriously – and prophetically – as Lawrence Peter Berra.

“When you come to a fork in the road, take it.”

Born to immigrants in St. Louis, storming the beach at Normandy, shot later in World War II, behind the plate for the New York Yankees, in the dugout for them and the New York Mets, kibitzing around New Jersey with his beloved wife, Carmen, Yogi Berra bebopped from place to place, moment to moment, his presence a vortex. Berra’s pull was gravitational, and it made his famous quotes all the more powerful. People didn’t latch on to what Berra said because of what he did. They found meaning in his words because of who he was. For the pocket philosopher who tries to translate Yogi-isms, this one – which sprung from a split road that ended up at his home on either path – is quite simple: Trust yourself.

“Baseball is 90 percent mental. The other half is physical.”

Yogi Berra was a mythical creature: the eminently likeable Yankee. He spent almost his entire career in pinstripes, save for four games as a player-coach with the Mets, and on teams with Joe DiMaggio and Mickey Mantle and Phil Rizzuto and Whitey Ford and Roger Maris, he was the lifeblood, the spiritual essence, the lunch-pail figure so beloved he inspired a cartoon character who loved nothing more than pilfering a good lunch. Never did Berra bother to correct his math here, though perhaps that was intentional. To do what he did for as long as he did may well have taken more than 100 percent.

“It’s like déjà vu all over again.”

Every year, it was almost the same. Yogi Berra would hit somewhere in the neighborhood of .300, get on base about 36 percent of the time, hit at least 20 home runs, drive in around 100 runs, strike out 20-something times and make the All-Star team long before it became a participation-trophy event. Fifteen straight times Berra was an All-Star, even toward the end of his career, long after the three MVP awards and seven top-four finishes. Every spring he would show up a year older, a step slower, a hair thinner, and he’d still be Yogi, forever Yogi.

“I always thought that record would stand until it was broken.”

The record will stand forever. Of every great thing Yogi Berra did on a baseball field – 358 home runs, 1,430 RBIs, a .285/.348/.482 line while regularly catching 140 games a season and 117 times doing so in both ends of a doubleheader – he won 10 World Series rings, a number that even though it was easier in the ’40s and ’50s and ’60s remains unfathomable today. Over his 19 seasons, Berra played in 14 World Series, a reflection not just of how the Yankees lorded over the sport but Berra’s central role. For the most successful franchise in sports history, he participated in more success than anyone.

“You can observe a lot just by watching.”

For all of George Steinbrenner’s brilliance as an owner, his stubbornness was poisonous, and when he fired Yogi Berra 16 games into the 1985 season, something was missing from the Bronx. By insulting and rejecting Berra, the Yankees actively choosing a life without him was like a shoe shunning its laces, a table snubbing its legs, a light fixture discarding its bulb. During the return of the Yankees’ glory days in 1996, the knowledge that the bridge separating Berra and the Yankees in reality was a few miles but in his mind was a million cast sadness and emptiness on this new era. Berra kept waiting and waiting and waiting for an apology, and when Steinbrenner acceded, it felt almost like an international peace accord. The Yankees held Yogi Berra Day in 1999, and for the next 15 years, health permitting, he was the team’s most visible legend. Ultimately, he knew life with the Yankees and life without them, and he knew which made him happiest.

“I never said most of the things I said.”

Time exaggerates words, and Yogi Berra’s existence was a huge game of telephone. He probably said some of the things attributed to him. He probably didn’t say others. Never did he go out of his way to correct the ledger, though, because he knew something that resonated far deeper than one would expect from someone of chronic misspokenness: The words fit who we wanted him to be, and as important as he was to his sprawling Berra clan, Yogi was also the people’s, and he’d always be.

“You should always go to other people’s funerals. Otherwise, they won’t come to yours.”

.Yogi Berra was beloved by modern Yankees legends such as Derek Jeter. (AP)

Yogi Berra was beloved by modern Yankees legends such as Derek Jeter. (AP)

They’ll come to his. They’ll come in droves, from all five boroughs and every corner of Jersey, from the rest of the northeast and the southeast and stretching across the United States, from remote places in the world so far away it seems impossible that one man’s web of influence could reach so many. They’ll come not just because he came to theirs, but because Yogi Berra’s is a life well worth celebrating.

“It ain’t over ’til it’s over.”

It’s over. It’s sad because we saw Yogi Berra slow down in recent years, and when someone whose wondrous mind always worked with a lilt of childishness loses that to old age it’s a harrowing reminder of fallibility and the vagaries of time. If it allows everyone across the game and the country and the world to remember him, though, to spread the wit and wisdom, then it dovetails with how he spent his 90 years. As a kid, Berra’s friends started calling him Yogi because how he sat resembled a yoga practitioner, and it stuck, even as he grew into a 5-foot-7, 185-pound squat, inflexible bowling ball. It fit, too, somehow, maybe because of the connotation of spirituality and philosophy and the unique place in history Berra occupies. He took the fork and ended up here, exactly where he belongs.